MOBILE BANKING

Mobile Banking App

As a Security First Credit Union member, you can access your accounts on your smartphone – manage your account from your living room couch or at the grocery store. It’s free and available to you with our mobile banking app.

- Free mobile check deposit

- Manage your SFCU Visa Cards with Free Card Management

- Internal and external account transfers

- Monitor your credit with SavvyMoney

- Send money with Zelle(R)

- Manage and pay bills with Bill Pay

- Instant balance option

- TouchID and facial recognition login

- Manage financial institutions

- Manage Two-Factor Authentication settings

Download the free app from iTunes®

or the Google Play™ store.

For a complete list of compatible devices,

please click here.

Bank By Phone

Our Free Bank by Phone automated system is an easy and fast way to access your account information while on the go!

You can:

- Review Checking & Savings account balances

- Review the last 5 deposits and transactions

- Review specific checks cleared

- Review electronic transactions

- Same account Transfers

- Cross Account Transfers

- Review Loan Information

- Review Certificate & IRA Information

When using our Free Bank by Phone system, be sure to have your account number and PIN number available. You will need this information to access your account.

Follow the steps below to get started:

- Dial: (956) 661-4000

- Press 1 to access the Free Bank by Phone System

- Press 1 to access your account information

- Enter your account number followed by the # sign

- Enter your PIN followed by the # sign

- Follow the menu prompts

Don’t have a Free Bank by Phone PIN? Contact our Call Center at 956-661-4000 for assistance.

Card Management

Conveniently and easily manage your Security First Federal Credit Union debit card on your time, anytime – directly from within online banking and the SFFCU mobile banking app.

Receive notifications for suspicious transactions and exceeding spending limits to ensure the safety and security of your credit. You can also review transactions and turn your card “off” if necessary.

Card Management Benefits

Easy Card Use

- Easily add cards to digital wallets

- Access card credentials without needing your physical card

- View one-time payments as well as automatic payments made from the card to merchants on a regular basis

Manage Cards On-the-Go

- Add both your SFCU debit card and SFCU credit card

- Manage cards with advanced controls and self-service options

- “On” and “Off” card management

- Control when, where, and how your cards are used

- Create travel plan notifications

- Hide and Show Cards

- Add a new SFFCU card

- Call designated phone numbers to:

- Activate cards

- Report a card lost or stolen

- Set or change PIN

Understand Spending with Spend Insights

- Check transactions and account balances

- Understand spending clearly with quick spending insights, recurring/card-on-file merchant identification, and transactions enriched with clear merchant names, logos, interactive maps, and contact information.

- Track recurring payments (subscriptions/installment plans) and keep a tab on merchants that have your card details stored.

- Set spending limits based on location, amount, merchant type, and transaction type

Real-Time Alerts

- View suspicious activity and help minimize fraud with real-time alerts

- Establish alerts for each time the card is used based on specific desired alerts or when a transaction is attempted but declined.

uChoose Rewards

- View and redeem uChoose rewards points

Digital Wallet

Pay Securely & Quickly Wherever These Mobile Payments Are Accepted!

Digital wallets offer a convenient and secure way to make in-store purchases using your mobile device. You can securely add your Security First Debit Card to make purchases at the store right from your mobile device, and you don’t even have to reach for your wallet! Make quick and secure in-store purchases with your SFCU Debit card from your smartphone, smartwatch, and tablet. It’s that simple! Learn more about SFCU’s debit and credit cards here.

To pay in-store, look for the contactless and/ or Apple Pay symbol at checkout. To learn more about using your SFCU debit card and Apple Pay, and to view the list of merchants where accepted, please visit apple.com/apple-pay.

Look for one of these symbols at checkout.

Google Pay works anywhere contactless payments are accepted. Simply unlock your smartphone and hold it near the card reader to pay. You don’t even have to open the app! To learn more, please visit pay.google.com/about.

Samsung Pay makes transactions easy. Just swipe up to launch the app, secure with authentication (either your fingerprint or passcode), and hover over the card reader to pay. To learn more, please visit samsung.com/samsung-pay.

*If you did not add your card to any of these services, or an attempt was made to add your card to these services but was unsuccessful, please contact us immediately at 956-661-4000 for assistance. Google Pay is a trademark of Google LLC. Samsung Pay is a trademark of Samsung electronics co., Ltd. Apple logo is a trademark of Apple, Inc.

To learn which devices Apple Pay is compatible with, please click here

Mobile Deposit

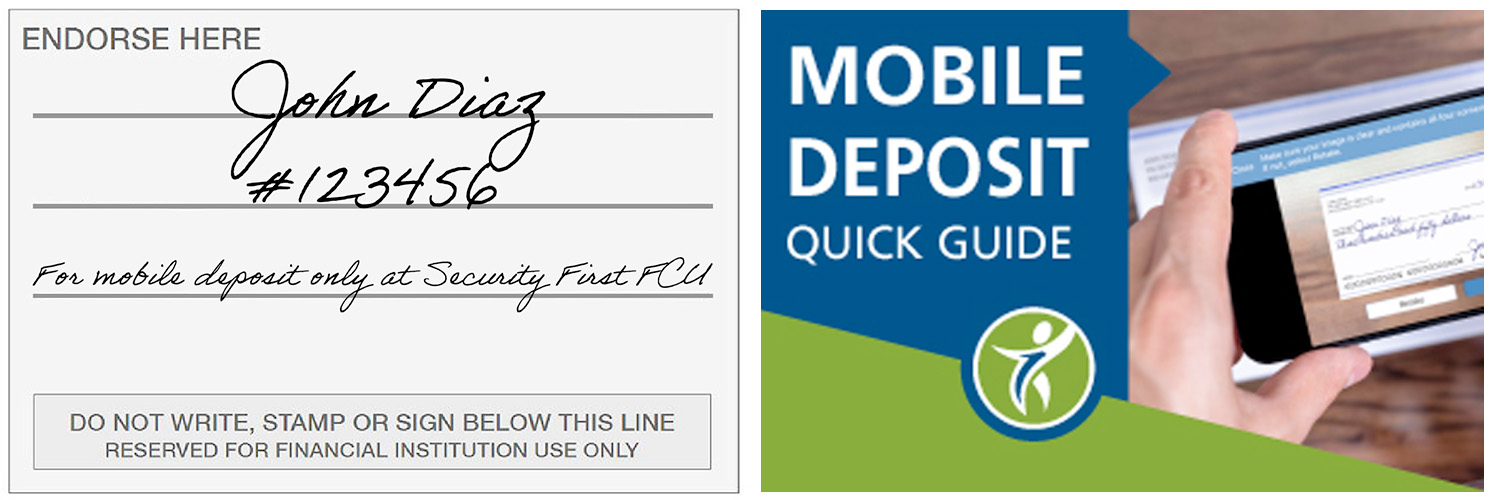

IMPORTANT: PLEASE MAKE SURE TO PROPERLY ENDORSE YOUR CHECK WHEN USING MOBILE DEPOSIT.

Please ensure it is properly endorsed by including:

- Your Signature

- Your Account Number

- Also, include, “For Mobile Deposit Only at Security First FCU”

Features:

- Available Free for iOS and Android with the Security First mobile banking App.

- Deposit checks from anywhere – it’s at your convenience!

- No need to visit the branch or ATM.

To access Mobile Deposit you will need to first have the SFCU mobile banking App and a online banking User ID. If you do not have this set up yet, please visit your nearest community branch or contact our Call Center at 956-661-4000 for assistance.

- First before taking a picture of your check, please ensure it is properly endorsed. It must include the following: your signature, your account number, and write “For Mobile Deposit Only at Security First FCU”.

- Next, open the mobile banking App, and select the Deposit feature.

- Now, take a clear picture of the front of the check and then of the back of the check.

- Once completed, press the “Make Deposit” button and you are all done!

Ready to get started?

Download the free app from iTunes® or the Google Play™ store:

Online Banking

Learn more about online banking or log in to view your account.

If you do not know your login, or if you have never used online banking before, please contact our Call Center at 956-661-4000, opt. 7, for assistance.

FAQs

How do I access the Mobile Deposit feature?

The mobile deposit feature is available only through our Security First Credit Union mobile banking app.

The app is available FREE through your mobile devices’ Apple or Android store App.

How long do checks take to post?

Our policy is to make the first $275.00 of your deposited funds available on the 1st business day after the day we receive your deposit, with the balance of such funds (up to $6,725.00) available on the 2nd business day after the day we receive your deposit. All other funds from your deposits will be available to you on the 5th business day after the day we receive your deposit. Further delays may apply.

How do I log in to the mobile banking app?

To log in, you will need a online banking user id. If you do not have this ID, please visit your nearest community branch or contact our Call Center at 956-661-4000.

What is the cutoff time?

The cutoff time is set for 4:00 pm. Any deposit made after 4:00 pm will be effective as of the next day.

Is there a daily deposit limit?

There is a limit of $2,500 per day per account.

Do I have to endorse the checks being deposited?

Yes. An endorsement is required for each check deposited. It must include the following: your signature, your account number, and write “For Mobile Deposit Only at Security First FCU.

Is Mobile Deposit available for all Security First Credit Union accounts?

Mobile Deposit is only available for share/savings, share drafts, and Money Management accounts. It is not available for business accounts.

Are there requirements for signing up for Mobile Deposit?

Members must have a online banking user id, an active account in good standing for 90 days or more, and a current address on file.

Do I need to keep checks after I use Mobile Deposit?

Yes. We recommend retaining all checks for a minimum of 90 days.

Text Alerts

With Text Banking*, you can enroll to receive text alerts* to help you monitor activity with your accounts. Choose the alert type and whether you want to be alerted by email, your mobile device, or both!

How to Set Up Text Alerts:

Log in to online banking

- Select Mobile from the top right menu.

- Accept the terms and conditions.

- Under the select services page, select Text Messaging and Alerts under the Other Services section.

- Click Continue.

- Next, choose your time zone and the accounts for which you want to receive alerts.

- Click Continue.

- Enter your mobile number and select Continue.

- You will receive an Activation Code text; enter that code into the Activation Code field.

Note: To receive text alerts, you must be enrolled in Text Banking.

Alert Types:

- Balance: greater than amount

- Balance: less than amount

- Credit Transaction: greater than amount

- Credit Transaction: less than amount

- Debit Transaction: greater than amount

- Debit Transaction: less than amount

- Secure Message

How to Create an Alert:

- Under Alert Type, select from the drop-down the type of alert you would like to set up.

- Select to send the alert via email and/or mobile device.

- If selecting by email, enter your email address in the email field.

- Once completed, click review.

- Below the alert setup box, you will be able to see a list of your active alerts.

*Message and data rates may apply from your wireless carrier.

Ready to get started?

Log in to your online banking account now!

Text Banking

When you’re on the go or internet access is limited, use text messaging to check your accounts – it’s a quick and convenient way to stay connected to your Security First accounts!

Features:

- Send a text message command to receive text message replies regarding the balance of your accounts.

- Receive Alerts

How to Set Up Text Banking*:

Log in to online banking

- Select Mobile from the top right menu.

- Accept the terms and conditions.

- Under the select services page, select Text Messaging under the Other Services section.

- Click Continue.

- Next, choose your time zone and the accounts for which you want to receive alerts.

- Click Continue.

- Enter your mobile number and select Continue.

- You will receive an Activation Code text; enter that code into the Activation Code field.

Text Banking Commands to 39872

- Text ‘BAL’ for your balances.

- Text ‘HIST’ plus your account’s texting nickname for a list of transactions (ex. HIST C1).

- ATM + Street or zip code

- Branch + Street or zip code

How to Manage Enrolled Devices:

Once you have successfully enrolled your mobile device, you can manage your devices simply by logging in to online banking and selecting mobile from the top right main menu.

Manage Mobile Banking Devices

- My Devices: change, add, or remove devices.

- My Accounts: change or add account nicknames.

- My Profile: Update your time zone

Ready to get started?

Log in to your online banking account now!

Zelle®

Zelle® is available right from your online and mobile banking account and conveniently located in the same place where you pay your bills.

It is easy to get started. Simply log in to your online banking account and enroll in Bill Pay. Once your account is verified, return to Bill Pay and select the “Send Money With Zelle®“ tab.

Enroll with Zelle® and start sending and receiving money with friends and family!

How to start using Zelle®

- Enroll or log in to Bill Pay

- Select “Send Money with Zelle®“

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

That’s it! You’re ready to start sending and receiving money with Zelle®.

Watch the video to learn more about Zelle®!

Frequently Asked Questions

What is Zelle®?

Zelle® is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes.3 With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank.2

WHO CAN I SEND MONEY TO WITH Zelle®?

You can send money to friends, family and others you trust.2

Since money is sent directly from your bank account to another person’s bank account within minutes,3 it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number.

HOW DO I ENROLL IN ZELLE®?

To start using Zelle® at Security First Credit Union, you must be enrolled in Bill Pay. If you are not already enrolled in Bill Pay, you can enroll by accessing our website and logging in to online banking. Locate the Bill Pay tab and follow the instructions to complete the Bill Pay enrollment steps. Once enrolled in Bill Pay, you can access “Send Money With Zelle® ” tab in Bill Pay to complete a brief one-time enrollment to tell us which email address or U.S. mobile number and deposit account you would like to use to send and receive money with Zelle®.

Note: Zelle® enrollment is not currently available through the mobile app; however, you will be able to access Zelle® with the mobile app once enrolled.

HOW DO I USE ZELLE®?

You can send, request or receive money with Zelle®.

To get started, log in to Security First Credit Union’s online banking or mobile app, navigate to Bill Pay and select “Send Money With Zelle®.” Accept terms and conditions, enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it and you’re ready to start sending and receiving with Zelle®.

To send money using Zelle®, simply add a trusted recipient’s email address or U.S. mobile phone number, enter the amount you’d like to send and an optional note, review, then hit “Send.” In most cases, the money is available to your recipient in minutes.3

To request money using Zelle®, choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request.”4

To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®.

SOMEONE SENT ME MONEY WITH ZELLE®, HOW DO I RECEIVE IT?

If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your bank account and will be available typically within minutes.3

If you have not yet enrolled with Zelle®, follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select Security First Credit Union.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification – you should enroll with Zelle® using that email address or U.S. mobile number where you received the notification to ensure you receive your money.

WHAT TYPES OF PAYMENTS CAN I MAKE WITH ZELLE®?

Zelle® is a great way to send money to family, friends and people you are familiar with such as your personal trainer, babysitter or neighbor.2

Since money is sent directly from your bank account to another person’s bank account within minutes,3 Zelle® should only be used to send money to friends, family and others you trust.

Neither Security First Credit Union nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

HOW DO I GET STARTED?

It’s easy – Zelle® is already available within Security First Credit Union’s mobile banking app and online banking within Bill Pay! Check our app or sign in online and follow a few simple steps to enroll with Zelle® today.

WHAT IF I WANT TO SEND MONEY TO SOMEONE WHOSE FINANCIAL INSTITUTION DOESN'T OFFER ZELLE®?

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient’s financial institution isn’t on the list, don’t worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number and a Visa® or Mastercard® debit card with a U.S.-based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

HOW DOES ZELLE® WORK?

When you enroll with Zelle® through your online banking Bill Pay account or mobile banking app, your name, the name of your financial institution and the email address or U.S. mobile number you enrolled is shared with Zelle® (no sensitive account details are shared – those stay with Security First Credit Union).

When someone sends money to your enrolled email address or U.S. mobile number, Zelle® looks up the email address or mobile number in its “directory” and notifies Security First Credit Union of the incoming payment. Security First Credit Union then directs the payment into your bank account, all while keeping your sensitive account details private.

CAN I USE ZELLE® INTERNATIONALLY?

In order to use Zelle®, the sender’s and recipient’s bank accounts must be based in the U.S.

CAN I CANCEL A PAYMENT?

You can only cancel a payment if the person you sent money to hasn’t yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel and then select “Cancel This Payment.”

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you aren’t able to get your money back, please call our member service team at (956) 661-4000 so we can help you.

Scheduled or recurring payments sent directly to your recipient’s account number (instead of an email address or mobile number) are made available by Security First Credit Union but are a separate service from Zelle® and can take one to three business days to process.

You can cancel a payment that is scheduled in advance if the money has not already been deducted from your account.

HOW LONG DOES IT TAKE TO RECEIVE MONEY WITH ZELLE®?

Money sent with Zelle® is typically available to an enrolled recipient within minutes.3

If you send money to someone who isn’t enrolled with Zelle®, they will receive a notification prompting them to enroll. After enrollment, the money will be available directly in your recipient’s account, typically within minutes.3

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle® and that you entered the correct email address or U.S. mobile phone number.

If you’re waiting to receive money, you should check to see if you’ve received a payment notification via email or text message. If you haven’t received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please contact our member support team at (956) 661-4000.

WILL THE PERSON I SEND MONEY TO BE NOTIFIED?

Yes! They will receive a notification via email or text message.

IS MY INFORMATION SECURE?

Keeping your money and information safe is a top priority for Security First Credit Union. When you use Zelle® within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe.

I'M UNSURE ABOUT USING ZELLE® TO PAY SOMEONE I DON'T KNOW. WHAT SHOULD I DO?

If you don’t know the person, or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle® for these types of transactions.

These transactions are potentially high risk (just like sending cash to a person you don’t know is high risk). Neither Security First Credit Union nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

WHAT IF I GET AN ERROR MESSAGE WHEN I TRY TO ENROLL AN EMAIL ADDRESS OR U.S. MOBILE NUMBER?

Your email address or U.S. mobile phone number may already be enrolled with Zelle® at another bank or credit union. Call our member support team at (956) 661-4000 and ask them to move your email address or U.S. mobile phone number to your financial institution so you can use it for Zelle®.

Once customer support moves your email address or U.S. mobile phone number, it will be connected to your bank account so you can start sending and receiving money with Zelle® through your Security First Credit Union banking app and online banking. Please call our member support team at (956) 661-4000 for help.

1 Mobile network carrier fees may apply.

2 Must have a bank account in the U.S. to use Zelle®.

3 Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle®.

4 In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

Copyright © 2021 Security First Credit Union. All rights reserved. Terms and conditions apply. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Security First Credit Union

3515 S. Jackson Rd

Edinburg, TX 78539

(956) 661-4000